Highlights

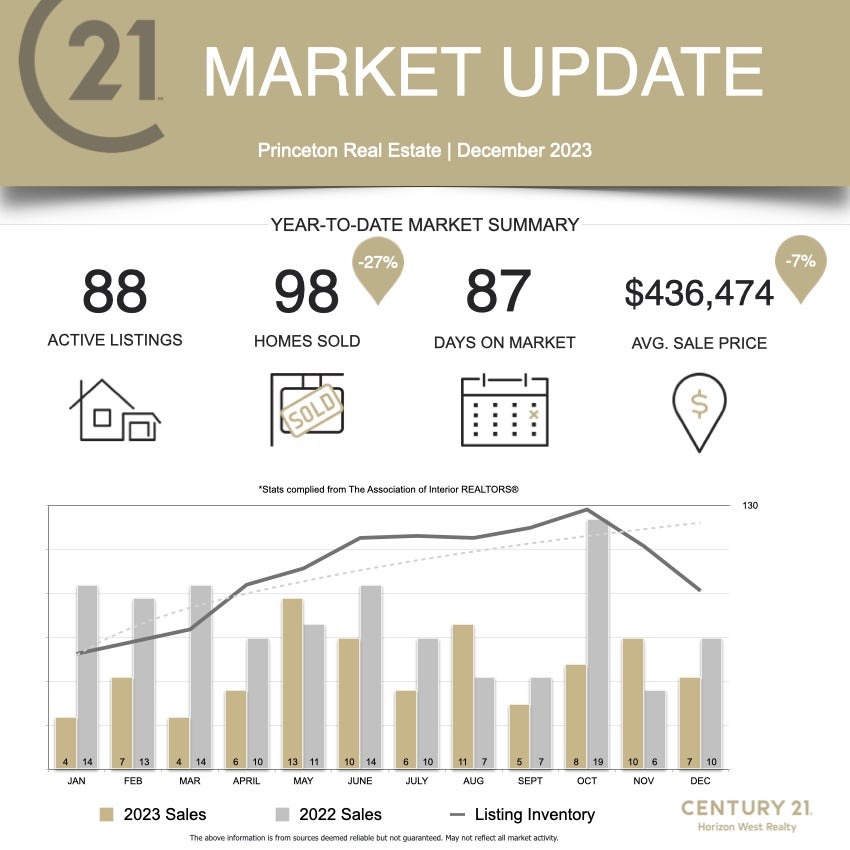

- Year-to-date property sales are down -27% compared to 2022

- Average sale price is down -7% compared to 2022

- 35% of all new listings sold year-to-date

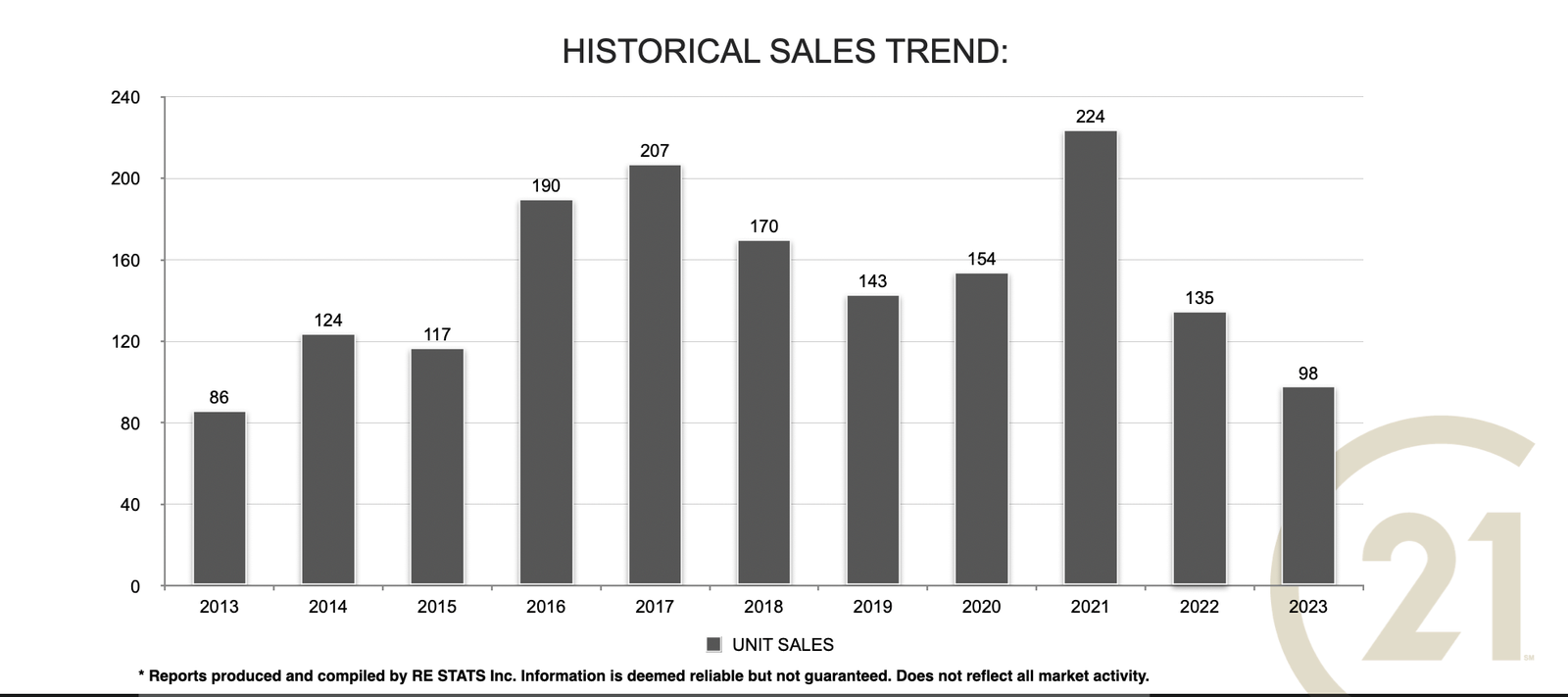

- Lowest unit sales numbers in a decade

- Expect a flat real estate market for 2024

- Interest rates remain a top concern for first half of 2024

- A surge in population growth will continue to affect housing availability and affordability

- Future government housing policies could be a market wildcard

What goes up must come down...

The 2023 real estate market felt the added pressure of higher interest rates that, coupled with a killer stress test threshold, pushed many potential buyers to the sidelines, forcing them to compete instead for rental housing. As sales peaked in 2021 and values peaked in 2022, this was the year I predicted that we would see some sort of market correction. Knowing that Princeton offers a high quality of life that people strive for, I am generally optimistic about long term real estate investments, as I have purchased Princeton real estate for myself in 2023, but I knew the ferocity of the market wasn't at a healthy and sustainable pace moving forward. 2023 Unit sales have dropped to a 10 year low where only 35% of all new listings sold. Those are significant numbers that, for some, created a challenging time to sell.

Outlook for 2024

Princeton's real estate market is currently facing challenges that impact both demand and supply dynamics. Economic uncertainties, changes in buyer behavior, and global influences are contributing to a more cautious market sentiment for 2024.

1. Economic Factors

It's widely forecasted that the Canadian economy will remain virtually flat for growth in 2024 with room for growth possibly later in the year, although the economy isn't likely to normalize to a better growth rate until 2025. On the plus side, buyer demand for investment property may remain strong as long as the property is cash positive.

Global uncertainties like regional wars and climate events; and local factors such as immigration, income levels and affordable housing can impact the decision-making process for those entering the real estate market. These unforeseen events can impact inflation, housing, interest rates and insurance premiums.

2. Housing Inventory:

Uniquely attributed to this market is limited housing supply. This continues to be a significant factor affecting the market. Large population growth from immigration and the slow pace of construction has not been sufficient to meet the growing demand. This shortage amplifies the competitive nature of the market, placing additional stress particularly on the rental market. Potential housing projects planned for 2024 would be a positive for affordable housing in Princeton, so we'll keep an eye out as these developments break ground.

3. Price Trends:

While there has been historical appreciation, recent trends suggest a more subdued environment. Princeton has witnessed a 7% price correction according to 2023 stats from the Interior Association of REALTORS. The recent update to the 2024 Property Assessments is indicating price depreciation trend as well. These trends can impact sellers, requiring a careful and strategic approach in the current market conditions as buyers become more price sensitive in the market.4. Mortgage Rates and Affordability:

The rapid rise in interest rates have substantially impacted the real estate market in 2023. There are several factors to keep an eye on in 2024. The Bank of Canada over night interest rate and Bond Yields. The BOC rate will affect variable mortgage rates and the bond market will impact fixed mortgage rates. There are plenty of reports predicting where rates will go (some positive and some negative), but no one knows exactly how 2024 will play out as there are a lot of factors and variables at play in both the national and global economies. The Stress Test regulation is also playing a big impact on real estate markets in Canada. On top of higher interest rates, buyers are being tested at up to 8% for mortgage approvals. This lofty threshold has proven to be quite the challenging for many buyers.5. Government Housing Policy

2023 has seen numerous federal and provincial policy measures made to address the housing crisis, including those in the provincial "Homes for People Plan" and the federal 2023 Fall Economic Statement. Some of these plans already include the following:

Conclusion:

- Bill 35: Short-Term Rental Accommodations Act will change how short terms rentals operate in BC.

- Bill 44: Housing Statutes (Res Development) Amendment Act will permit one secondary suite or laneway home in all BC communities and require denser zoning bylaws in municipalities of more than 5,000 people.

- Bill 46: Housing Statutes (development Financing) Amendment Act: Requires local governments to reduce current rezoning processes and provide a more transparent understanding of housing project costs including changes to Development Cost Charges.

- Speculation & Vacancy Tax: This tax has been expanded to 13 new municipalities including - Vernon, Coldstream, Penticton, Summerland, Lake Country, Peachland, Courtney, Como, Cumberland, Parksville, Qualicum Beach, Salmon Arm and Kamloops. This additional tax will included Recreation property owners as well.

As the federal and provincial governments feel more public pressure to at least look like it's doing something meaningful with housing, we may see many future implementations to housing legislation that can cause positive or negative ripple affects to the real estate market.

Conclusion:

The after affects of a global pandemic has made quite the unique market that I have never seen in my 16+ years working in the industry. The fundamentals aren't what you would typically see in a real estate market (high prices mixed with low demand and low inventory). As we try to normalize the economy moving forward, the bond yields will be an indicator, but it really comes down to inflation and interest rates. The Bank of Canada's recent announcement to keep the benchmark interest rate unchanged at 5% shows that inflation has likely peaked. It’s widely believed that the BOC may deliver the first rate cut sometime around the first quarter to half of 2024. Bond yields have been slowly dropping, but we'll need to see a further reduction in inflation before we see major changes in Canadian mortgages.

I am anticipating a flat market for 2024 that will improve in the latter half of the year based on an expected lowering of the interest rates. I'm expecting to see slightly improved unit sales with the average sales value to drop approximately 5% compared to 2023. The good news for buyers who are considering a purchase, is less competition and an increased inventory offers more choice and may lead to more negotiating power. It's crucial for both buyers and sellers to approach transactions with a realistic understanding of the current dynamics. Seeking professional advice from a Century 21 Horizon West agent and staying informed about market trends is more important than ever in navigating these challenges. Don't hesitate to contact us for more consultation regarding buying or selling property in the Similkameen Valley.

Happy New Year and best wishes from our C21 family to yours!

~ Lee Mowry

Disclaimer: The information provided in this blog is for informational purposes only and should not be considered as financial or real estate advice. Readers are encouraged to consult with professional advisors for personalized guidance.