The real estate market may see a tumultuous time moving into 2023, as rising interest rates will directly impact real estate values across the board. One of the biggest economic issues that seems to be spreading across North America is the widening gap between the wealthy and the poor (including the middle class). The biggest reason for this goes back to the financial collapse of 2008, where the wealthy have been able to leverage their cash and continue to invest their money at the expense of lower income citizens.

Below is a great video that explains how the financial collapse of 2008 continues to affect our markets and cost of living today:

Cooling Off Period to be Implemented in 2023

Moving forward into 2023, we will see more real estate regulatory changes implemented by the government (specifically in British Columbia). Their goal is to continually dampen the real estate market, and in this case, provide buyers more advantageous options when purchasing residential real estate.

Starting in January 2023 the B.C. government will implement changes to the Property Law Act to make the Home Buyer Rescission Period (“HBRP”) or ‘cooling-off period’ mandatory for residential real estate transactions.

The HBRP will allow homebuyers to rescind a contract to purchase residential real estate within the set period, even if the contract does not include conditions. It will begin the next business day after the final acceptance of an offer. The rescission period will be in effect for three business days and cannot be waived by either the seller, buyer, or their representatives. During this period, homebuyers can still legally withdraw from the purchase without justification at the cost of a rescission fee equal to 0.25 per cent of the purchase price.

The HBRP and any subject conditions in the contract of sale both start counting down at the same time and run concurrently if subject conditions have been included in the contract of sale.

Foreign Buying in Canada

The government is imposing other legislation to protect Canadian real estate from speculative foreign buyers:

Temporary Ban on Foreign Buyers

The federal government has also introduced legislation that bans the purchase of residential real estate by non-Canadians. The Prohibition on the Purchase of Residential Property by Non-Canadians Act (the “Act”) comes into force on January 1, 2023, and is stated to stay in force for a period of at least two years.Federal Unused Property Tax

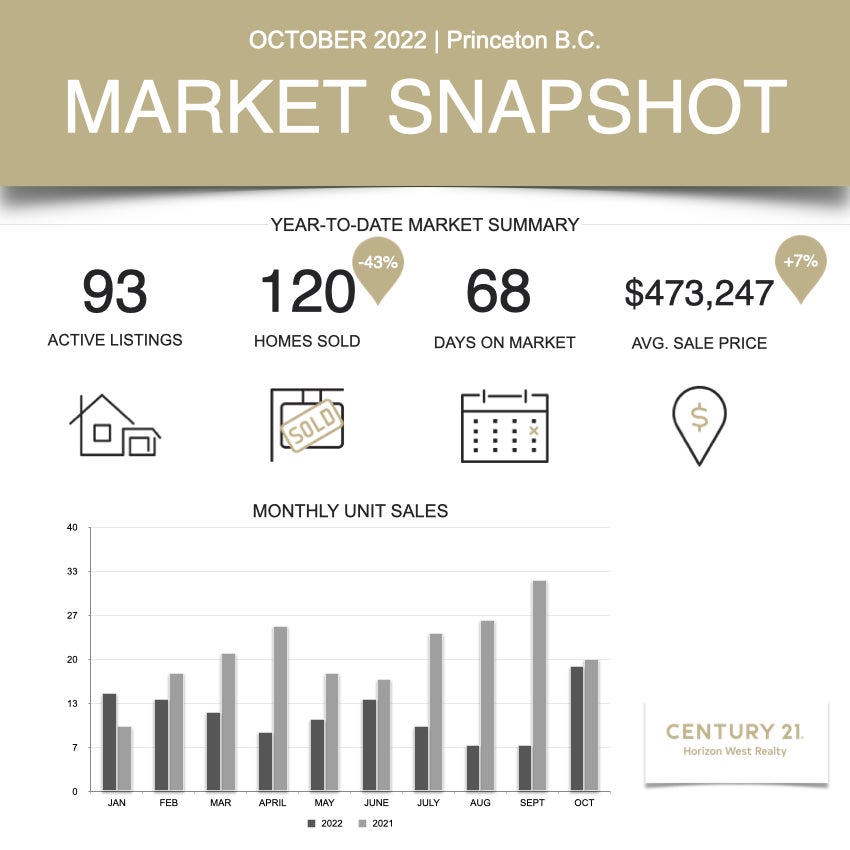

For foreigners that already own residential real estate in Canada, the Underused Housing Tax (UHT) is an annual tax on the value of non-Canadian-owned residential real estate that is considered vacant or underused.Princeton October 2023 Stats

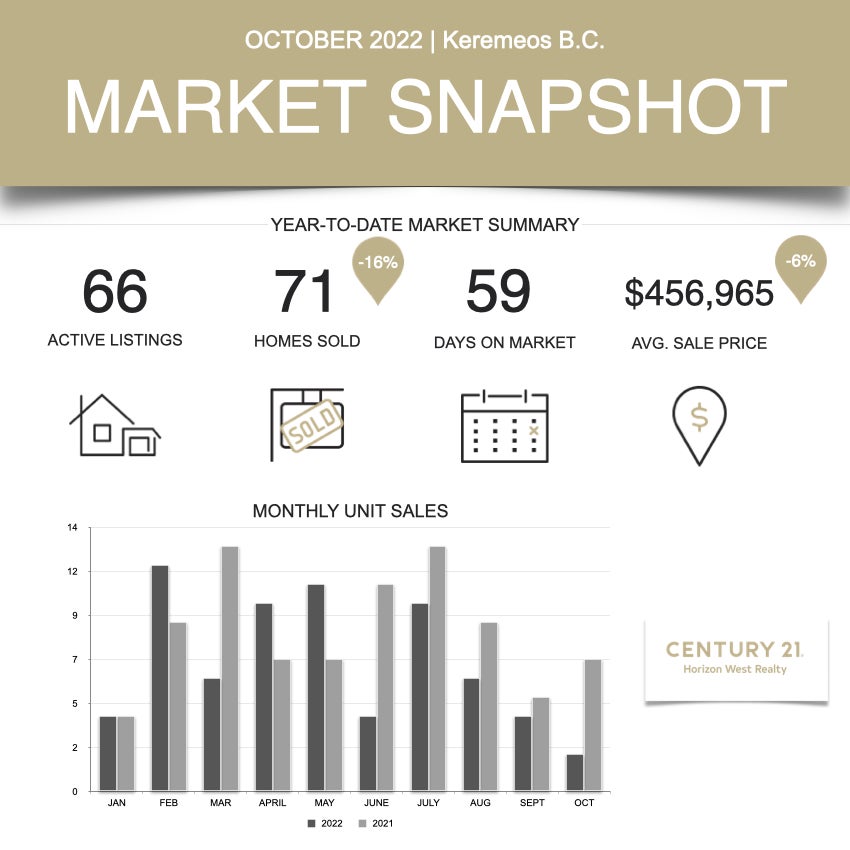

Keremeos October 2023 Stats

Questions?

If you have any questions regarding the real estate market or the coming regulatory changes, you may contact your Century 21 Horizon West Realty agent for more information. We provide you the answers to help make a better informed decision when buying or selling real estate in a challenging market.